Bahrain Streamlines SWIFT Codes for Faster Global Transfers

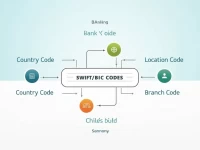

International money transfers to Bahrain require the correct SWIFT/BIC code. These codes can be found through online tools, bank websites, and other resources. It is crucial to verify the SWIFT code to ensure the successful completion of the remittance. Double-checking the code with the beneficiary bank is highly recommended to avoid delays or complications in the transfer process.